Treasury Policy

Introduction

This policy sets out the key controls placed on the treasury management function within Finance at the University. It contains guidance on a number of key areas and focuses upon the risks that the University faces in its day-to-day activities.

The CIPFA Code

The Chartered Institute of Public Finance and Accountancy (CIPFA) reissued a revised Treasury Management Code in 2021. The University has broadly adopted the format of this code.

The following four clauses are taken from the code and are adopted by the University as the basis for its treasury management policy:

1. The University will create and maintain, as the cornerstones for effective treasury management:

– a treasury management policy statement, stating the policies and objectives of its treasury management activities (this policy)

– suitable treasury management practices (TMPs), setting out the manner in which the University will seek to achieve those policies and objectives, and prescribing how it will manage and control

those activities.

The content of the policy statement and TMPs will follow the recommendations contained in Sections 6 and 7 of the Code, subject only to amendment where necessary to reflect the particular circumstances of the University. Such amendments will not result in the University materially deviating from the Code’s key recommendations.

2. Scrutiny and Finance Committee will receive reports on its treasury management policies, practices and activities, including, as a minimum, an annual strategy and plan in advance of the year and an annual report after its close, in the form prescribed in its TMPs. The annual strategy will be reported to Council.

3. Scrutiny and Finance Committee delegates responsibility for the implementation and regular monitoring of its treasury management policies and practices to the Director of Finance (except where

specifically indicated in the Policy). The Director of Finance will ensure the execution and administration of treasury management decisions in accordance with the University’s policy statement and TMPs and, if he/she is a CIPFA member, CIPFA’s Standard of Professional Practice on Treasury Management.

4. The University nominates Scrutiny and Finance Committee to be responsible for ensuring effective scrutiny of the Treasury Management strategy and policies.

Should there arise any conflict between this Treasury Policy, and the Financial Regulations, the Financial Regulations should be taken as having precedence.

Appendix D sets out the annual decisions delegated to Scrutiny and Finance Committee, as well as those decisions in which Investments and Development Committee is involved.

Treasury Management Policy Statement

The CIPFA Treasury Management Code recommends that the University adopt the following form of words to define the policies and objectives of its treasury management activities:

1. The University defines its treasury management activities as:

The management of the University’s investments and cash flows, its banking, money market and capital market transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks. For the avoidance of doubt, it does not include the management of the University’s long term investments, which fall under the remit of Investments and Development Committee.

2. The University regards the successful identification, monitoring and control of risk to be the prime criteria by which the effectiveness of its treasury management activities will be measured. Accordingly, the analysis and reporting of treasury management activities will focus on their risk implications for the University.

3. The University acknowledges that effective treasury management will provide support towards the achievement of its business and service objectives. It is therefore committed to the principles of achieving value for money in treasury management, and to employing suitable comprehensive performance measurement techniques, within the context of effective risk management.

In addition, The University’s other stated objectives are:

• To maintain financial stability;

• To minimise the costs of funds, in relation to the University’s debt;

• To maximise returns on investments, within an agreed risk profile;

• To preserve the University’s cash balances from any loss;

• To minimise fluctuations in accounting profit, resulting from interest rate and foreign currency exposure;

• To ensure all borrowings are in compliance with the requirements of the Office for Students;

• To ensure compliance with any relevant banking or debt covenants

Treasury Management Practices

1. Risk management

General statement

The Director of Finance will design, implement and monitor all arrangements for the identification, management and control of treasury management risk, will report at least annually on the adequacy/suitability thereof, and will report to UEB or to Council as required, as a matter of urgency, the circumstances of any actual or likely difficulty in achieving the University’s objectives in this respect. In respect of each of the following risks, the arrangements which seek to ensure compliance with these objectives are set out throughout this document.

1.1 Credit risk management

The University regards a key objective of its treasury management activities to be the security of the principal sums it invests. Accordingly, it will ensure that its counterparty lists and limits reflect a prudent attitude towards organisations with whom funds may be deposited, and will limit its investment activities to the instruments, methods and techniques referred to in section 4 Approved instruments, methods and techniques. It also recognises the need to have, and will therefore maintain, a formal counterparty policy in respect of those organisations from which it may borrow, or with whom it may enter into other financing arrangements.

1.2 Liquidity risk management

The University will ensure it has adequate though not excessive cash resources, borrowing arrangements, overdraft or standby facilities to enable it at all times to have the level of funds available to it which are necessary for the achievement of its objectives.

The University will only borrow long-term in advance of need where there is a clear business case for doing so and will only do so for approved capital commitments.

The University should maintain and formally identify a formal liquid asset reserve. The amount of the reserve should be reviewed regularly by Investments and Development Committee. The current reserve is £30m, of which £10m should normally be held in cash as working capital. A total of £20m of other liquid assets from the University’s endowment funds will in the first instance be designated as the current liquid reserve, accepting that this may place some restrictions on its future use. Investments and Development Committee may designate other investments or cash balances at some point in the future. An outline of the Liquidity Policy can be found in Appendix C, and Appendix D sets out formally the role of Investments and Development Committee in this decision.

1.3 Interest rate risk management

The University will manage its exposure to fluctuations in interest rates with a view to containing its interest costs, or securing its interest revenues, in accordance with the amounts provided in its budgetary arrangements as amended in accordance with section 6 Reporting requirements and management information arrangements.

It will achieve this by the prudent use of its approved financing and investment instruments, methods and techniques, primarily to create stability and certainty of costs and revenues, but at the same time retaining a sufficient degree of flexibility to take advantage of unexpected, potentially advantageous changes in the level or structure of interest rates. This should be the subject to the consideration and, if required, approval of any policy or budgetary implications.

1.4 Exchange rate risk management

It will manage its exposure to fluctuations in exchange rates so as to minimise any detrimental impact on its budgeted income/expenditure levels.

The University transacts in a wide variety of foreign currencies, with only EUROs being received and expended in any significant amounts.

The University’s standard policy is not to speculate in currencies and to minimise accounting losses by paying foreign currency creditors promptly, and by translating foreign currency receipts promptly and by banking them regularly in the sterling account (with the exception of EUROs). An exception to this is prefinancing for EU funded contracts (see below).

EUROs are frequently received on behalf of sub-contractors and partners on European projects, and then distributed to those third parties.

EUROs will not normally be held by the University, except where

• there is an identifiable short term (normally less than one month) liability to pay third parties in EUROs, and then only to the extent of that liability.

• EU pre-financing funds are being held pending release by an audit approved certification.

• a float of EUROs will be maintained to pay suppliers. This float should not normally exceed EUR 1,000,000

To this end, Research Accounts and the Treasury Assistant must be informed of any EURO receipts immediately, whereupon Research Accounts will provide the Treasury Assistant with a EURO cash flow forecast relating to the receipt, showing how much of the receipt is due to the University and how much is due to partners, giving a due date. The amount due to the University will be translated immediately.

For any EUROs that are not translated immediately, the Treasury Assistant will seek to maximise interest earnings by placing EURO funds on deposit for appropriate periods with the University’s bankers.

The introduction of electronic purchase to pay means that for most cases payments made in a currency other than sterling will be recorded as a creditor on the University’s ledger system before they are paid. Orders can be raised in most currencies; the sterling value of the commitment, and of the subsequent creditor after receipt of the goods/services, will be based upon a monthly exchange rate held in the University’s ledger system. The payment of an invoice, at a spot rate, will give rise to either an exchange gain or loss. This gain or loss, unless there is a contracted exchange rate in force (e.g., for an EU contract), will be taken to the account code and project on which the order was originally raised. This is likely to be a school or function code, as opposed to central funds.

The University also issues invoices in foreign currency. Again, any foreign exchange rate gain or loss arising when such an invoice is settled will be taken to the account code and project where the invoice was originally raised (unless other agreements are in place, for example in the case of research contracts with a fixed rate).

Under EU Framework regulations, any interest generated on undistributed pre-financing may be taken into account when calculating the final amount due to the University as part of the research contract, and therefore the University must be able to identify how much interest has been generated by these amounts.

1.5 Refinancing risk management

The University will ensure that its borrowings, private financing and partnership arrangements are drawn up to provide both flexibility and value for money. To minimise risk, the University will avoid overreliance on any one source of funding.

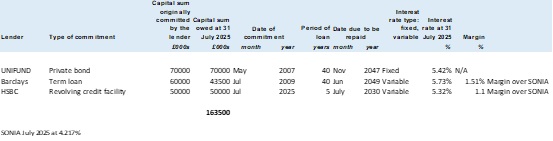

Loan Arrangements

See the table below for details of the University’s loan arrangements.

The Treasury Manager is responsible for monitoring the University’s compliance with loan covenants, and preparing any reports to lenders as set out in loan agreements.

1.6 Legal and regulatory risk management

The University will ensure that all of its treasury management activities comply with its Financial Regulations and other regulatory requirements. In framing its credit and counterparty policy under section 5 Credit and Counterparty Risk Management, it will ensure that there is evidence of counterparties’ powers, authority and compliance in respect of the transactions they may effect with the University, particularly with regard to duty of care and fees charged.

The University recognises that future legislative or regulatory changes may impact on its treasury management activities and, so far as it is reasonably able to do so, will seek to minimise the risk of these impacting adversely on the University.

1.7 Fraud, error and corruption, and contingency management

The University will ensure that it has identified the circumstances which may expose it to the risk of loss through fraud, error, corruption or other eventualities in its treasury management dealings. Accordingly, it will employ suitable systems and procedures, and will maintain effective contingency management arrangements, to these ends.

1.8 Market risk management

The University will seek to ensure that its treasury management policies and objectives will not be compromised by adverse market fluctuations in the value of the principal sums it invests, and will accordingly seek to protect itself from the effects of such fluctuations.

2 Performance measurement

The University is committed to the pursuit of value for money in its treasury management activities, and to the use of performance methodology in support of that aim, within the framework set out in its treasury management policy statement.

Accordingly, the treasury management function will be the subject of ongoing analysis of the value it adds in support of the University’s stated business or service objectives. It will be the subject of regular examination of alternative methods of service delivery, and of the scope for other potential improvements.

For non-core daily surpluses, the following performance measure is to be adopted:

• Comparison to three month SONIA

• The base rate is to be included for comparison purposes.

• This information will be distributed to the Director of Finance, and included in the University’s Management Information Pack (MIP). On a yearly basis, this comparison will be presented to Scrutiny and Finance Committee for information, along with the revised TreasuryPolicy.

The adoption of a performance measure should not be interpreted as undue pressure on the University to attain certain rates; the aim remains to balance the pursuit of optimum attainment with the need for both flexibility and risk management. Should funds available for investment be immaterial, or the returns generated also immaterial, the reporting restrictions above may be suspended until such time as sufficient funds can be invested that provide meaningful management information. This decision should be made by the Director of Finance and recorded in the annual Treasury Management report to Scrutiny and Finance Committee.

3 Decision-making and analysis

The University will maintain full records of its treasury management decisions, and of the processes and practices applied in reaching those decisions, both for the purposes of learning from the past, and for demonstrating that reasonable steps were taken to ensure that all issues relevant to those decisions were taken into account at the time. These will be filed and retained according to the University’s statutory requirements for keeping records.

4 Approved instruments, methods and techniques

The University will undertake its treasury management activities by employing only those instruments, methods and techniques detailed in the schedule to this document, and within the limits and parameters defined in section 1 Risk management.

The University does not in its normal course of events engage in the use of derivatives (potentially volatile tradable financial instruments whose values may be determined by the movement of an underlying asset or exchange rate). Examples of these may be forward contracts, options, swap agreements or any other arrangement structured to hedge against FOREX or interest rate movement. Historically, the University’s future cash flows denominated in foreign currency have not proven predictable enough to make the use of such instruments either cost-effective or efficient. Moreover, the use of hedging arrangements may expose the University to unwanted FOREX risk if wrongly or inappropriately used.

Any requests to fix exchange rates through any mode of hedging must be addressed to the Director of Finance in the first instance. If the likely impact of exchange rate hedging on operating performance exceeds £100k, Scrutiny and Finance Committee must approve. Scrutiny and Finance Committee shall approve all other forms of derivative transaction, such as interest rate swaps or

fixes.

5 Organisation, clarity and segregation of responsibilities, and dealing

arrangements

The University considers it essential, for the purposes of the effective control and monitoring of its treasury management activities, for the reduction of the risk of fraud or error, and for the pursuit of optimum performance, that these activities are structured and managed in a fully integrated manner, and that there is at all times a clarity of treasury management responsibilities.

The principle on which this will be based is a clear distinction between those charged with setting treasury management policies and those charged with implementing and controlling these policies, particularly with regard to the execution and transmission of funds, the recording and administering of treasury management decisions, and the audit and review of the treasury management function.

If and when the University intends, as a result of lack of resources or other circumstances, to depart from these principles, the Director of Finance will ensure that the reasons are properly reported in accordance with section 6 Reporting requirements and management information arrangements, and the implications properly considered and evaluated.

The Director of Finance will ensure that there are clear written statements of the responsibilities for each post engaged in treasury management, and the arrangements for absence cover. The Director of Finance will also ensure that at all times those engaged in treasury management will follow the policies and procedures agreed by the University.

The Director of Finance will ensure there is proper documentation for all deals and transactions, and that procedures exist for the effective transmission of funds.

The delegations to the Director of Finance in respect of treasury management are set out in the University’s Financial Regulations, and amplified below. The Director of Finance will fulfill all such responsibilities in accordance with the University’s Treasury Policy.

Transfer of Funds to Subsidiary Companies

The Treasury Assistant is authorised to make transfers of amounts between University accounts (Call Account, Petty Cash accounts, etc.) without need for a counter- signatory.

The Treasury Assistant is authorised to make these transfers.

No transfers can be made to dormant subsidiaries without the approval of the Director of Finance.

The Treasury Assistant is authorised to make transfers of funds from UK subsidiaries to the University, providing that (a) such sums represent income received by the subsidiary and (b) the subsidiary’s liabilities are normally settled by the University’s AP function, and any cash at bank held by the subsidiary is therefore not required to pay suppliers.

To other branches or subsidiaries (in Malaysia, Germany, Finland, South Africa, India or elsewhere), the Director of Finance must authorise payment.

A number of subsidiaries have a formal loan agreement in place with the University, which govern repayments, interest rates, etc. Before any sums are transferred to / from an entity, the terms of these agreements should be examined by the Treasury Manager to ensure that the proposed transaction is in accordance with the agreement, and the Director of Finance see evidence of this before authorisation The agreements should be reviewed on an annual basis by the Group Financial Accountant to ensure compliance with local legislation and accounting standards.

Where there is no formal loan agreement in place, the University pays (and receives) interest to (from) subsidiaries based on the level of inter-company indebtedness. The rate applied in this case is based upon the University’s actual return on its short-term cash investments.

Authorising Short-Term Investment of Surpluses

Based on the University’s daily cash position, and using information regarding market conditions, the Treasury Assistant will recommend the amount and period for lending. The overnight call account is used only as a contingency arrangement, usually for funds that have arrived too late in the day to be placed on the money market, or if the interest receivable on deposit exceeds the call amount interest by less than the transfer cost.

An approved list of counterparties can be found in Appendix A. This list of counterparties are all UK-based and likely to enjoy some level of UK government support; they represent a low-risk range of counterparties. The Treasury Manager can approve all lending within the terms and limits in this approved list. All approved counterparties must have a credit rating within the ranges set out in appendix B.

The University receives regular credit rating updates, to ensure individual ratings are monitored. Each month a summary of institutional ratings is obtained and saved on a shared Finance drive. The Treasury Manager will monitor all approved counterparty credit ratings on a weekly basis.

The Treasury Manager is responsible for alerting the Director of Finance to all changes in credit ratings relating to the above counterparties. In the event of a downgrade, the following procedure should be followed:

• If after the downgrade, the counterparty remains within the credit limits set out in appendix B, then the University may continue to invest on the discretion of the Director of Finance

• If the counterparty no longer remains within the limits in appendix B, then the University should cease using that counterparty as soon as practicable without jeopardising the capital invested.

Counterparties can be added to or removed from the approved list in Appendix A on the approval of the Director of Finance, but again only as long as new counterparties meet the credit ratings in Appendix B. Such changes must be reflected in the next version of the Treasury Policy submitted to Scrutiny and Finance Committee for approval.

Should the Director of Finance consider that the credit ratings in Appendix B are no longer workable or appropriate, then a revised set of minimum credit ratings must be presented to Scrutiny and Finance Committee as soon as practicable.

At the discretion of the Director of Finance, arrangements for longer terms than one year can be made with University’s current bankers (Lloyds) where there is a compelling financial reason to do so and, in particular, where investment returns are greater than would be available from funds invested for less than one year.

There may be times when, due to timing issues and the size of a receipt, it is not possible to place the funds on deposit, and thereby an amount greater than £20m is held with the University’s main bankers. Normally the amount of time such funds remain with the University’s main bankers should be limited to a maximum of one week. The Director of Finance should be alerted immediately to any breach of the £20m limit with Lloyds.

6 Reporting requirements and management information arrangements

The University will ensure that regular reports are prepared and considered on the implementation of its treasury management policies; on the effects of decisions taken and transactions executed in pursuit of those policies; on the implications of changes, particularly budgetary, resulting from regulatory, economic, market or other factors affecting its treasury management activities; and on the performance of the treasury management function.

As a minimum;

Scrutiny and Finance Committee will receive:

• an annual report on the strategy and plan to be pursued in the coming year

• an annual report on the performance of the treasury management function, on the effects of the decisions taken and the transactions executed in the past year, and on any circumstances of non-compliance with the University’s treasury management policy statement and TMPs

• an annual statement on compliance with Loan Covenants, also including compliance with any sanctions requirements imposed by lenders /bankers

Review Period

This policy will be reviewed annually.

7 Budgeting, accounting and audit arrangements

The University will account for its treasury management activities, for decisions made and transactions executed, in accordance with appropriate accounting practices and standards, and with any regulatory requirements in force for the time being.

8 Cash and cash flow management

The University will manage liquidity through management of debtors and creditors balances, and through cash flow forecasting.

Unless statutory or regulatory requirements demand otherwise, all monies in the hands of the University will be under the control of the Director of Finance and will be aggregated for cash flow and investment management purposes. Cash flow projections will be prepared on a regular and timely basis, and the Director of Finance will ensure that these are adequate for the purposes of monitoring compliance with TMP1[1] liquidity risk management. The present arrangements for preparing cash flow projections, and their form, are set out below:

A rolling 24-month daily cash flow will be prepared and maintained by the Treasury Manager. This plan will agree, on a monthly basis, with the University 10-year cash flow forecast.

Each day, the level of project cleared funds will be established using this forecast and the University’s internet banking platform.

The cash flow and projected cleared fund will be used to establish the level of surplus cash available for lending, and the period for which it is available.

On a weekly basis the Treasury Assistant will produce:

• 8 week rolling cash flow forecast

• A summary of short-term cash deposits

The Director of Finance should be specifically alerted to all forecast negative cash balances. The University will inform the Office for Students of all negative net cash book balances that meet their criteria for notification.

The Director of Finance will be responsible for long-term cash flow forecasting (i.e. periods of between 1 year to 10 years) and the production of forecasts for submission to the Office for Students.

9 Money laundering and Sanctions

Money Laundering

Money laundering is the act of concealing or disguising the nature, location, source, ownership or control of money in order to avoid a transaction reporting requirement and/or to disguise the fact that the money was acquired by illegal means.

The University is alert to the possibility that it may become the subject of an attempt to involve it in a transaction involving the laundering of money. Accordingly, it will maintain procedures for verifying and recording the identity of counterparties and reporting suspicions, and will ensure that staff involved in this are properly trained.

The Universities anti-money laundering policy

The Head of Transactional Services is responsible for implementing procedures around receiving and refunding money.

Any suspicions of money-laundering should be communicated to the Director of Finance, following the procedure set out in the policy. Should any other fraudulent activity be suspected, reference should be made to the University’s Fraud Policy and Fraud Response Plan.

Sanctions

The University’s Treasury Manager will liaise with the University’s bankers in relation to any reporting requirements in relation to sanctions imposed upon certain countries or individuals.

10 Training and qualifications

The University recognises the importance of ensuring that all staff involved in the treasury management function are fully equipped to undertake the duties and responsibilities allocated to them. It will therefore seek to appoint individuals who are both capable and experienced and will provide training for staff to enable them to acquire and maintain an appropriate level of expertise, knowledge and skills. The Director of Finance will recommend and implement the necessary arrangements.

The current job description of the Treasury Manager specifies a qualified accountant. On a yearly basis the Treasury Manager will, as part of the Professional Development Review process, identify areas where potential training needs arise and organise suitable materials for this.

The Treasury Policy will be made available to all University members via the Finance Website. All staff with Treasury responsibilities will be supplied with a copy.

11 Use of external service providers

The University recognises that whilst at all times responsibility for treasury management decisions remains with the University there is the potential value of employing external providers of treasury management services, in order to acquire access to specialist skills and resources. When it employs such service providers, it will ensure it does so for reasons which will have been submitted to a full evaluation of the costs and benefits. It will also ensure that the terms of their appointment and the methods by which their value will be assessed are properly agreed and documented, and subjected to regular review. And it will ensure, where feasible and necessary, that a spread of service providers is used, to avoid overreliance on one or a small number of companies. Where services are subject to formal tender or re-tender arrangements, legislative requirements will always be observed. The monitoring of such arrangements rests with the Director of Finance.

12 Corporate governance

The University is committed to the pursuit of proper corporate governance throughout its businesses and services, and to establishing the principles and practices by which this can be achieved. Accordingly, the treasury management function and its activities will be undertaken with openness and transparency, honesty, integrity and accountability.

The University has adopted and has implemented the key recommendations of the Code. This, together with the other arrangements detailed in this document, are considered vital to the achievement of proper corporate governance in treasury management, and the Director of Finance will monitor and, if and when necessary, report upon the effectiveness of these arrangements.

13 Ethical Banking

The University recognises the importance of aligning its banking relationships with its wider social responsibilities. The University will therefore adopt the following principles:

1. The University will consider Ethical, Social and Governance criteria in its choice of banking partner;

2. The University will monitor the progress of its banking partners in reducing their carbon footprint;

3. The University will monitor the progress of its banking partners in reducing their exposure to lending to the fossil fuel sector.

4. The University will consider ESG-related borrowing in any future debt it takes on.

5. The University will expect to receive annual updates on ESG issues from its banking partner(s) and will include a summary of this as part of this annual report to SFC.

Conclusion

This Treasury Policy will be revised annually, as noted above, and presented to Scrutiny and Finance Committee. Should, however, any urgent issue arise, the Director of Finance can request that the Treasury Manager revise the Policy, and present it to the next meeting of the Committee for approval. The Treasury Manager shall be responsible for alerting the Director of Finance any issues that they believe may require any such amendment.

Version 17

S E Mealor

Treasury Manager

Emma Ashley

Director of Finance

November 2025

Approved by Scrutiny and Finance Committee, 5 January 2026

Appendix A

The Treasury Manager can approve investments with the following counterparties, who at the time of approval of this policy meet the requirements found in Appendix B.

| Name of Counterparty | Size £m |

Duration | S&P | Moody's | Fitch |

| Royal London Cash plus fund | 20 | n/a | n/a |

n/a | AAA |

| HSBC | 20 |

3 months |

A1 |

P1 | F1+ |

| Lloyds (inc BoS) |

20 | 3 months | A1 | P1 | F1+ |

| Barclays Bank PLC |

20 | 3 months | A1 | P1 | F1 |

| Santander | 20 | 3 months | A1 | P1 | F1 |

| Nationwide | 20 | 3 months | A1 | P1 | F1 |

For any deposits over three months, the Director of Finance must approve.

Credit ratings correct as of 20/10/2025

Appendix B

• An acceptable banking counterparty meet at least two of the ratings below:

| S&P rating |

Moody’s rating | Fitch rating |

| A1 | P-1 |

F-1 |

• For a money market fund, a credit rating of AAA from any of the three main rating agencies is required.

Appendix C –Liquidity Policy

Liquidity Policy

• The University will if possible maintain £30m of its Long Term Investment Fund in liquid enough form to be realised within three months.

• The University should ensure it can obtain a £10m overdraft facility with its current bankers at short notice (defined as within three months).

• The University should aim to keep at least £10m of cash at all times, and this should be reflected in its long-term planning. However, it is recognised that this might not always be possible to external circumstances.

• This policy is to be approved annually by Scrutiny and Finance Committee and passed to Investments and Development Committee for implementation.

Appendix D

Summary of Key Links between the Treasury Policy and University Committees, and the Decisions Delegated to these Committees

The University’s Council delegates oversight over the Treasury Policy to Scrutiny and Finance Committee, under the heading of “Recommending to the Council and implementing general financial Policy, including the Treasury Policy” (point 6 a(ii) in its Terms of Reference)

In addition, the University’s Investments and Development Committee remit touches upon the University’s Treasury Policy, as the Treasury Policy is closely linked to key aims of the Investments and Development Committee.

Information Received and Decisions Undertaken by Scrutiny and Finance Committee in Relation to the Treasury Policy

• To receive an annual report on the strategy and plan to be pursued in the coming year

• To receive an annual report on the performance of the treasury management function, on the effects of the decisions taken and the transactions executed in the past year, and on any circumstances of non-compliance with the University’s treasury management policy statement and TMPs

• To receive an annual statement on compliance with Loan Covenants, also including compliance with any sanctions requirements imposed by lenders/ bankers

• To approve the updated treasury policy, including the list of counterparties and minimum short-term deposit credit ratings therein

• To receive and approve a copy of a Liquidity Reserve Policy, which will then be passed to Investments and Development Committee for their implementation

• To approve any amendments to minimum short-term credit ratings on an ad hoc basis throughout the year

The normal timetable for the presentation of the annual report and Treasury Policy shall be annually, in January

Information Received and Decisions Undertaken by Investments and Development Committee in Relation to the Treasury Policy

• To receive as soon as possible after Scrutiny and Finance Committee a copy of the approved Treasury Policy, and all other reports outlined above

• To receive the Liquidity Reserve Policy after it has first been approved by Scrutiny and Finance Committee